Debt structure

Sandvik's debt structure includes:

- Bonds, Medium-Term Notes (MTN)

- Bank loans

- Commercial papers

| Outstanding amount |

Equivalent in MSEK |

||

|---|---|---|---|

| Long term | 82% | ||

| Medium-Term Notes MSEK |

0

|

0 | |

| Medium-Term Notes MEUR |

2,097 MEUR

|

22,690 | |

| Bank loans MUSD |

0

|

0 | |

| Bank loans MEUR |

650 MEUR

|

7,033 | |

| Bank loans other |

130 MSEK

|

130 | |

| Short term | 18% | ||

| Commercial paper MSEK |

3,785 MSEK

|

3,785 | |

| Commercial paper MEUR |

126 MEUR

|

1,367 | |

| Medium-Term Notes MSEK |

0 MSEK

|

0 | |

| Medium-Term Notes MEUR |

74 MEUR

|

799 | |

| Bank loans other |

398 MSEK

|

398 | |

| Back-up facilities | |||

| Revolving Credit Facility MSEK | 0 MSEK | 0 | |

| Credit Facility MEUR | 0 MEUR | 0 | |

| Total | 36,202 | ||

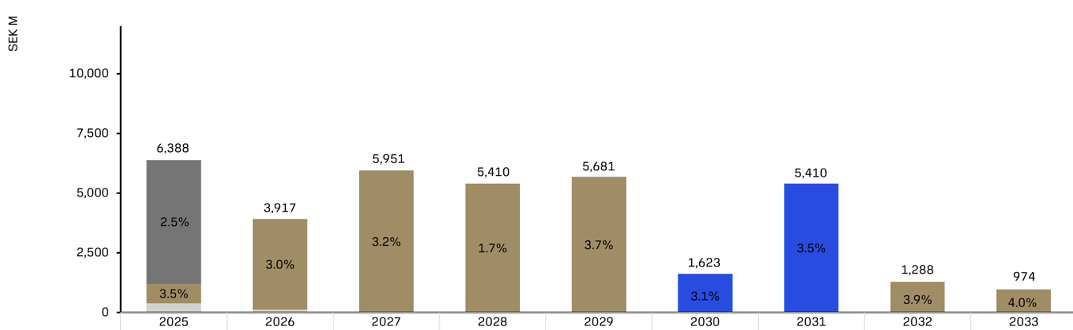

Loan maturity profile March 31, 2025

| Type of debt | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 | 2033 |

|---|---|---|---|---|---|---|---|---|---|

| Commercial paper | 5,189 | - | - | - | - | - | - | - | - |

| Bonds | 801 | 3,787 | 5,951 | 5,410 | 5,681 | - | - | 1,288 | 974 |

| Other subsidiary loans | 398 | 130 | - | - | - | - | - | - | - |

| Bank loans | - | - | - | - | - | 1,623 | 5,410 | - | - |

| Total | 6,388 | 3,917 | 5,951 | 5,410 | 5,681 | 1,623 | 5,410 | 1,288 | 974 |