Financial targets

Sandvik has long-term financial targets focusing on growth, profitability, financial position and dividend.

You are now visiting the Sandvik Group website in English. Would you like to switch to another language site with selected content translated?

Sandvik has long-term financial targets focusing on growth, profitability, financial position and dividend.

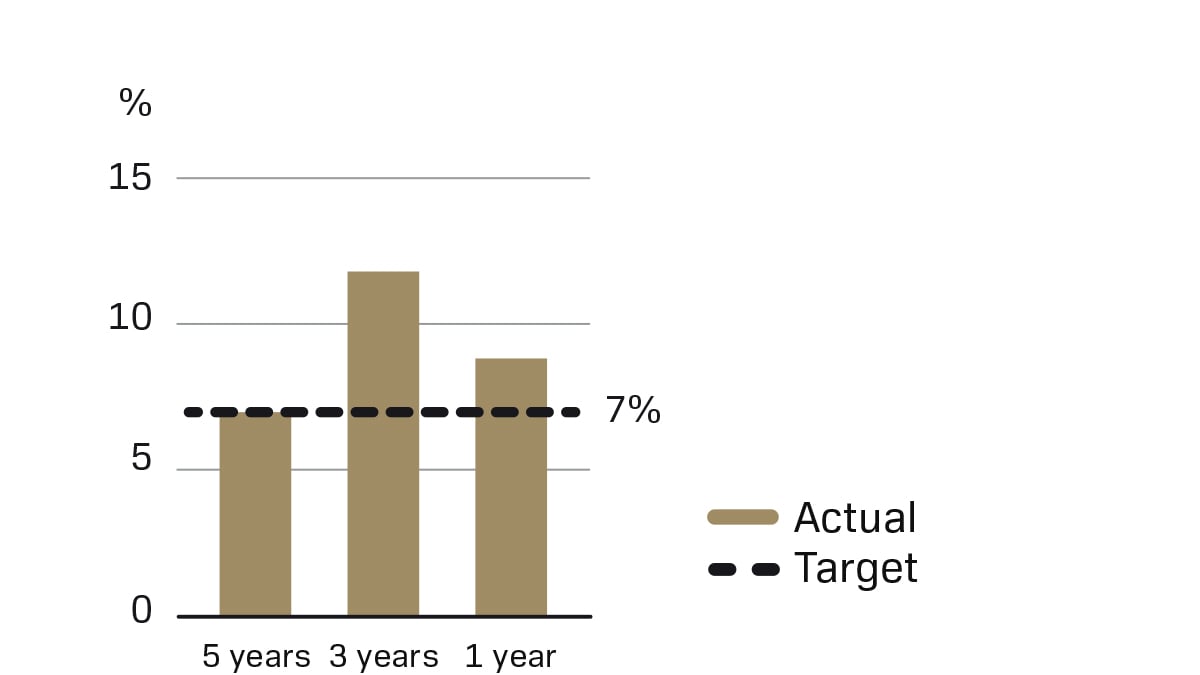

A growth of 7 percent through a business cycle, organically and through acquisitions.

A revenue growth (CAGR vs 2019) of 9 percent. In 2023, total growth at fixed exchange rates was 9 percent, of which organic growth was 6 percent. Revenue growth was 12 percent over a three-year period and 7 percent over a five-year period.

Read about how our solid financial position supports our shift to growth

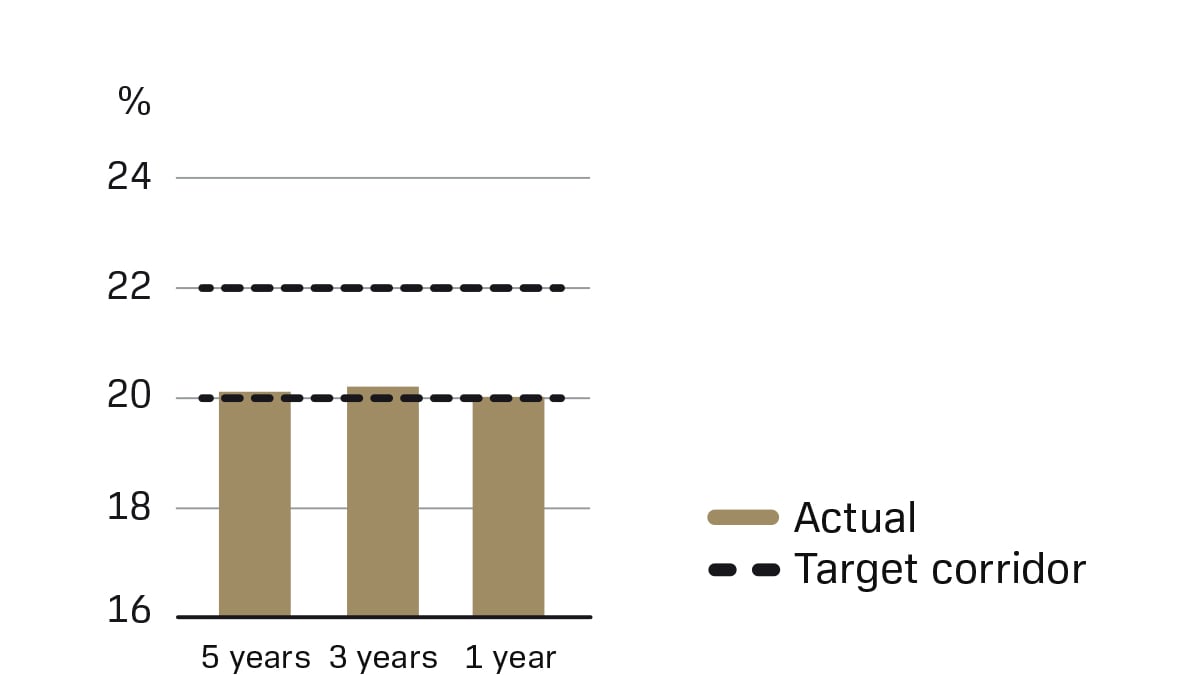

An adjusted EBITA margin range through a business cycle of 20–22 percent.

The adjusted EBITA margin amounted to 20.0 percent (20.0), in line with the target.

Read more about how we will achieve our trough EBIT margin target

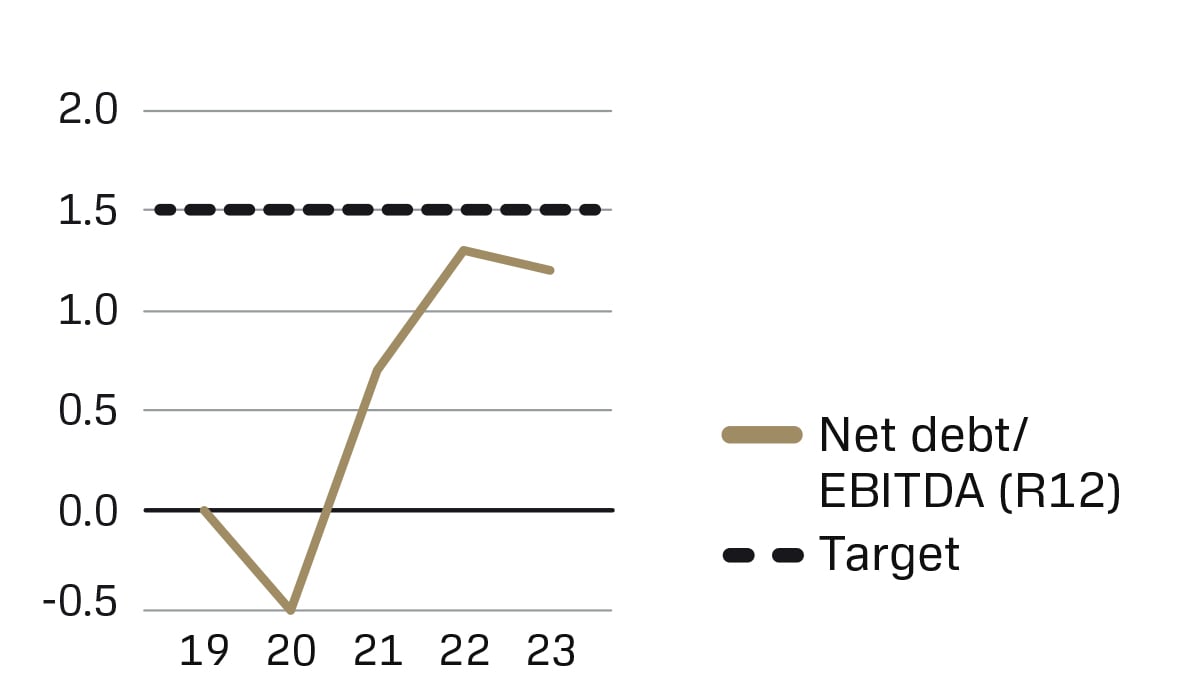

A financial net debt/EBITDA ratio (excluding transformational M&As) below 1.5.

The target was achieved as the financial net debt/EBITDA ratio was 1.2.

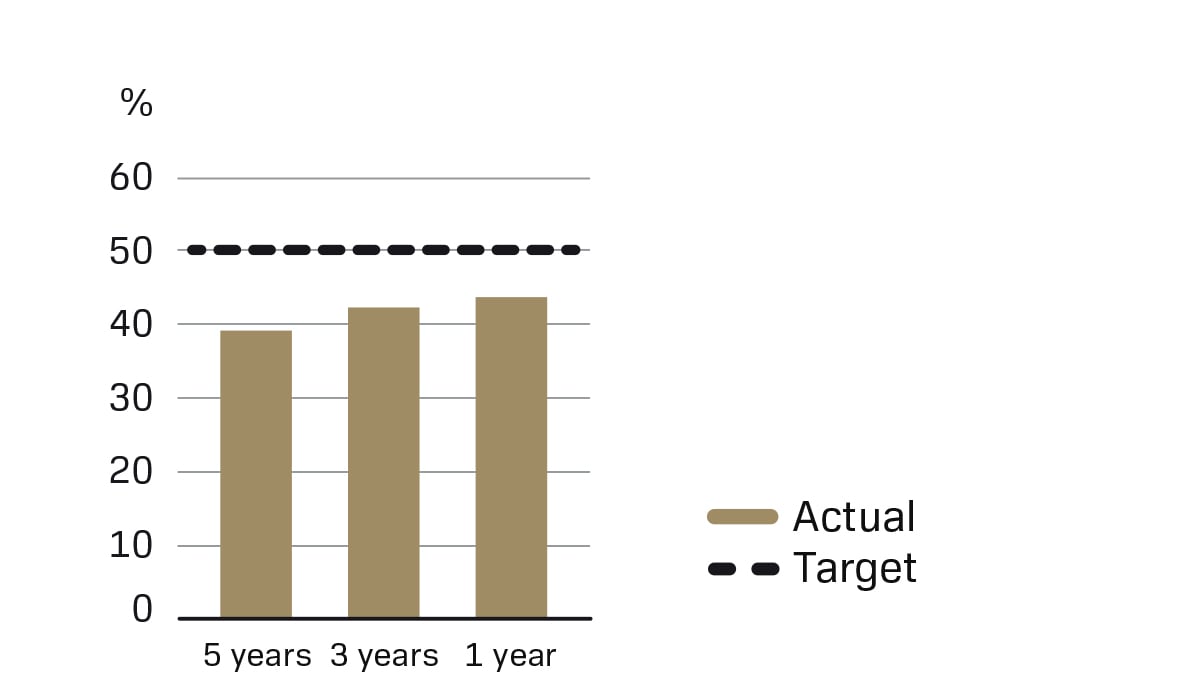

A dividend payout ratio of 50 percent of earnings per share, adjusted for items affecting comparability, through a business cycle.

A solid performance in 2023 resulted in a proposed dividend of SEK 6.9 billion (6.3) corresponding to a payout ratio of 43 percent. The average payout ratio for a three-year period amounted to 42 percent and for a five-year period to 39 percent.

Read more about our commitment to generating maximum shareholder value

Target outcomes are 2023 results. All figures except financial net debt/EBITDA are excluding Alleima and other operations for previous years.

*The dividend payout ratio is only related to cash dividends and does not consider the distributed value from Alleima to shareholders in 2022. The ratio is calculated on adjusted earnings per share, diluted, for the total Group for all years except 2022 when it excludes earnings related to Alleima.

We have set sustainability goals in selected focus areas and we report on KPIs for our operations to track progress towards targets. In addition to our own operations, we also work with customers and suppliers to achieve the goals.